By Skoden Ventures, via Medium

June 7, 2023

My mother had a saying: “you don’t see us on our knees.” This is a Lakota value my mom learned growing up in South Dakota and passed down to me. What it means is that we identify what people need, and we try to meet their needs before they ask. We look out for each other. We don’t exploit other’s weaknesses for our self-gain.

I’ve brought these values of kinship and generosity to my work with Skoden Ventures, and I’m troubled when I look at the current culture of venture financing, which seems to be driven mostly by greed and narcissism instead of mutual prosperity and compassion.

Although income levels are low on Native American reservations in South Dakota — like the one I was born on — these same communities are also very rich in culture, heritage, and teachings. Lakota people are some of the most resilient and generous people. We live close to our values: respect, honor, and compassion — to name a few. To live by these values means that we make sure no one in our community has to beg or go without.

Today we increasingly live in an economy that meets the needs of fewer and fewer, making a handful of individuals obscenely wealthy. But Skoden Ventures is working to build an economy that meets the needs of the many and empowers those looking for the same thing.

Another thing I learned from my mother is that a big part of suffering is the feeling of watching others flaunt what they have and while you go without. That’s why my mother would always tell me not to brag about what I have or not to eat food in front of people who are hungry. These values my mom taught me are hardwired into how I live, and I believe they drive the passion I’ve brought to Skoden for growing opportunities for our communities.

PSYCHOLOGICAL BAIT OF BAD ACTORS

I’m always thinking about the impact I potentially have on the people, places and things around me. That’s why I cringed when reading Erin Griffith’s recent New York Times exposé, “The End of Faking It in Silicon Valley” in which she details the rampant fraud and malfeasance running amok within the “unicorn tech” startup world.

Griffith covers a laundry list of recent news about consequences and failures in the Silicon Valley economy, from the deflation of the cryptocurrency bubble, to the collapse of Silicon Valley (and now First Republic) Bank, to the high profile arrests of fad-to-fraud founders like Elizabeth Holmes and Sam Bankman-Fried.

She describes a conversation with a consultant who helps investors develop protocols to “help identify the telltale signs of “Machiavellian narcissists” who are more likely to commit fraud”.

But, really, if you are an investor, and you have to hire a consultant to tell you whether the founders you’re thinking about investing in might display signs of being “Machiavellian narcissists,” something is wrong. Very wrong. Yet that’s the current landscape of Silicon Valley analyzed in Griffith’s article.

If a lot of this seems obvious, you’re not wrong! But I know that plenty of people grow up with values similar to mine, so it makes me wonder: why do investors continue to take the bait proffered by bad actors?

I went looking for research, and I found a Harbin Institute of Technology study that determined that VCs traditionally invest in founders with narcissistic personality traits because of an assumption there is a correlation between narcissistic and entrepreneurial traits. Narcissists overestimate their own work ethic and contribution of value, which can seem attractive to potential investors on the lookout for confidence and devotion to growth. Narcissists may also be more overly competitive, which can signal a drive to succeed.

At first blush, I can understand this. I’ve been in rooms with plenty of narcissists and had to listen to them brag about how great they are and how what they are building is so amazing (and lucrative) that ends justify the means. Often, these are the people who don’t take me seriously — because I’m Brown, because I’m Native, because I’m a woman, a young mom, take your pick — and in my uphill battles, I’ve sometimes doubted myself in rooms with people like this.

But they’re fake. Ultimately these behaviors and traits are hollow versions of truly visionary leaders, creating an illusion that ends up fooling investors. These illusions hide what behavioral scientists call the “dark triad” motivations: Machiavellianism, narcissism, and psychopathy.

Often, these are the people who don’t take me seriously — because I’m Brown, because I’m Native, because I’m a woman, a young mom, take your pick — and in my uphill battles, I’ve sometimes doubted myself in rooms with people like this. But they’re fake.

Unsurprisingly, this dark triad is bad news. In “Entrepreneur or Narcissist? A Venture Capitalist’s’ Field Guide,” Blackhawke Behavior Science suggests that “entrepreneurs high on all three of the dark triad traits are more likely to have self-serving motives and overestimate their abilities.” The same article goes on to identify the underlying motivations these entrepreneurs hold, which shape their leadership behaviors. These include:

- To achieve financial success, even if it is a little destructive to society

- To maximize profits, even at the cost of employees’ well-being

- To grow quickly, even if that means sacrificing quality

- To earn a financial profit at all costs.

This success-at-all-costs model creates a feedback loop whose eventuality is often the collapse you read about in the headlines. I don’t see why it has to be this way. Across a long enough time horizon, desperation for growth and profit leads to nothing but suffering. Wouldn’t it be better to invest in founders with whom you share values from the beginning? To foster mutual trust and a clear vision of shared prosperity? To take into account the generations that will follow us, and reap the results of what we have sown today?

Thankfully, investors are beginning to ask these same questions as they grow more wary of hyper-capitalism, consider their legacy to future generations, and examine the foundation of the house of cards that hyper-capitalism has built.

We are in an urgent global moment that calls for long-term sustainable solutions, not get-rich-quick business models and schemes. As a capital allocator, I know that keeping a narcissism spotter on the payroll is not the solution. Instead, I understand that a company’s foundational values — not its schemes or promises, not the hype of the moment — but its demonstrable core values — are what truly determine the possibility of a company’s long-term sustainable growth and value creation.

In sum, here’s what I’ve learned: companies driven by their values deliver more value for you and future generations.

That’s why we are building a new model for investing in companies, to ensure we multiply more than financial capital. Enter Skoden Ventures.

THE SKODEN DIFFERENCE

When I met my co-founder Alice Loy, we immediately hit it off. She has an irreverent, often salty sense of humor, and her values align with mine. Despite being from Orange County, CA, Alice was raised by a Quaker mom, with a dedication to the values of stewardship and equality, and a strong belief that investment returns are defined not just by dollar signs but by beneficially contributing to the social and natural assets of our communities.

Similarly, growing up on and off the Cheyenne River Reservation in South Dakota, I was taught from childhood that communities look out for each other, and social relation is more important than individual consumption. We come from worlds apart, and yet we have so much in common!

Our alignment has already witnessed the fruits of a values-first approach. Companies we have accelerated or been early investors in — like Meow Wolf and Embodied Labs — have now generated over $200 million in annual revenues and have raised over $315 million. They have created over 2,500 jobs. And 54% of these founders have been women, while 52% are BIPOC.

Alice and I were co-leading one of the early Creatives Indigenous accelerator programs together in Denver when I began to ask why more investors aren’t using values-based screening to choose investments in venture funds and startups. And, more specifically, why are Indigenous investors and values largely absent from the startup and impact investing space?

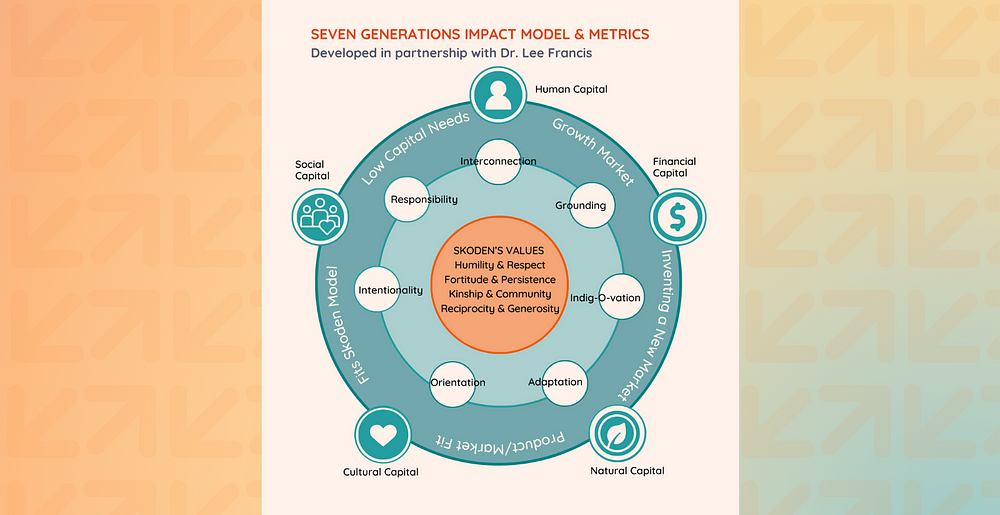

Over the course of several months, as Alice and I explored answers to these questions, we started to put into place the foundation of Skoden Ventures, a new kind of venture fund where we invest in startups that generate returns across the Five Forms of Capital: human, cultural, social, natural, and financial.

Skoden Venture Partner, Lee Francis, PhD (Laguna Pueblo), has helped us design a new impact model, grounded in Indigenous values and perspectives. As we build out the model, and apply it to companies we invest in, our intention is to create a methodology for both startup founders and impact investors that accounts for the real returns of investors’ financial capital.

Over the coming months we’ll post updates on the methods and share what we are learning as we work with founders who share our values, embody the leadership qualities that shape resilient organizations, and multiply our investors’ financial capital along the way to expanding human, natural, social, and cultural capital.

And here’s one struggle we won’t have: finding founders who share our beliefs. We have already met them, and they’re already succeeding. Because they know — like us — the success that businesses can achieve from expanding the five forms of capital rather than eroding the social, cultural, and natural ties that bind humanity.

VALUES ON THE RISE

More and more companies are embracing the holistic stakeholder model, as evidenced by the 38% increase from 2018 to 2022 in applications for B-Corp certification, a designation managed by the global nonprofit B Lab that companies are “meeting social sustainability and environmental performance standards.” And B-Corp certification is good for business, as Patagonia executive Vincent Stanley points out that “B Corps outperform conventional investments, even during their early years.”

Here are more facts about the successful bet of value-driven companies:

- Consumers appreciate values: according to a Deloitte consumer survey, 80% of consumers are “willing to pay more if a brand is environmentally and socially responsible.”

- And the next generation of consumers appreciate values even more: Millennials and Gen Z command $2 trillion in spending power, and they’re adamant about authenticity and principles. 94% believe that companies have the responsibility to make the world a better place through what Entreprenuer.com identified as “job placement for neighbors and a cycle of money that stays in the local economy.”

- Value-driven companies perform more successfully over a longer period: In their touchstone text Corporate Culture And Performance, celebrated economic researchers John Kotter and James Heskett crunch the numbers to show that “purposeful, value-driven companies” have 12 times the stock price of other companies over a decade.

- Socially conscious corporations are better at weathering recessions: B-corps (such as Ben & Jerry’s, Patagonia, The Body Shop, Tom’s, Warby Parker) were 64% more likely to survive and grow during the last major recession in 2008/2009, and they had employee growth rates 13% higher than the national average.

The science and the stories match. Companies driven by their values stick around longer, retain more passionate employees, and appeal to the rising generations of Millennials and Gen Z consumers. Founders who build from core values that account for future generations, will outpace the “unicorns” that crumble into Trojan horses.

Faking it is out — resilience and collective empowerment is in. It’s time to start considering how we, as investors, can catch up to these changing winds before it’s too late. Because we can only avoid our own role in this cold splash of reality for so long. As VC vet DC Palter wisely put it for Entrepreneur’s Handbook: “We as investors create the atmosphere for fiction, then act surprised when we find out the story was embellished, the assumptions overly optimistic, the truth spun to tell us what we demand to hear.”

Founders who build from core values that account for future generations, will outpace the “unicorns” that crumble into Trojan horses.

Demand to hear a different truth. Don’t be fooled by shortsighted bravado. Invest for the future with people who have been taught not the tricks for one success but the values to keep succeeding, the values that inspire trust. When it’s all said and done, do you want to tell horror stories about the founder hijinks that fooled you? Or do you want to leave a legacy of long-term prosperity and collective success?

I know where I stand, and I am proud that my mother and my community taught me so carefully how (and who) to trust. If you’re curious about Skoden and learning how we grow these companies for long-term prosperity, we invite you to join our growing community of values-driven investors. Let’s go then, and let’s go now!

Skoden Ventures invests in Indigenous, Black, Brown, and women founders building growth companies in entertainment, experiential tech, creative products, and services.

Find out more about our mission as well as how to pitch for investment at skodenventures.com. Have questions? Email us at info@skodenventures.com

Follow us on Instagram, Twitter, TikTok, or LinkedIn to stay up-to-date on Skoden news!